Exness Standard Account

The Exness Standard Account will suit any trader, from the most inexperienced to the most professional. Basically, it provides a perfectly balanced mix of highly competitive trading conditions with extra accessibility. This account type includes such features as tight spreads, no commissions on trades, and flexible leverage. All this may be suitable for both new and experienced traders in trading. Besides, one gets access to a great variety of instruments: Forex, commodities, and cryptocurrencies. This makes it possible to implement any strategy in a very easy way and at low costs.

What Are Exness Standard Accounts?

Equally popular among traders, an Exness Standard Account is so friendly and convenient. The accounts are targeted towards both novice traders and professionals who want a competitive trading environment with no commissions charged on trades and low spreads from 0.3 pips. Leverage options are pretty flexible and range from 1:2 to 1:unlimited. Given these flexible options in leverage, traders can easily manage risks in view of their trading style and market conditions. The Standard Account provides access to a great variety of financial instruments in Forex, commodities, cryptocurrencies, and other markets, thereby giving great flexibility for trading different strategies.

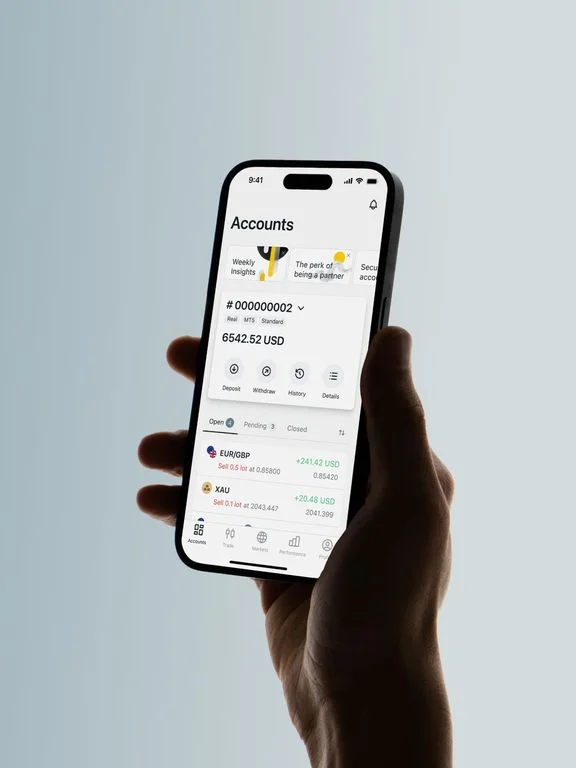

Among the principal advantages of an Exness Standard Account is its simplicity and user-friendly interface. It is always an excellent option for those who are going to trade for the very first time, and it’s simple to set up an account without complicated conditions. Among its features are the instant execution of orders, guaranteeing traders’ orders are executed quickly and accurately to avoid slippage. Moreover, the Exness Standard Account holder is provided with the opportunity for trading using MT4 and MT5 platforms that provide access to an enormous variety of instruments and functions for perfecting conditions of trading, technical analysis, and trading automation options.

Types Exness Standard Accounts

Exness offers its traders two kinds of standard accounts: the Standard and the Standard Cent Accounts. With these account types, Exness offers traders competitive conditions and access to a wide variety of instruments with flexibility when trading. That means they are targeted at different levels and styles in trading. Whether you’re just starting out or looking to improve your strategies, Exness’s Standard Accounts have something suitable for every trader.

| Feature | Details |

| Minimum Deposit | No fixed minimum deposit (varies by payment method) |

| Leverage | Up to 1 |

| Spreads | From 0.3 pips |

| Commission | No commission fees |

| Trading Instruments | Forex, Metals, Cryptocurrencies, Indices, Energies, Stocks |

| Execution Type | Market Execution |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Exness Terminal |

| Swap Fees | No swap fees on major forex pairs |

| Order Types | Market, Limit, Stop, Trailing Stop |

| Ideal for | All types of traders, particularly those who want a standard trading environment without commission fees |

Standard Account

The Standard Account really is the account for traders who are looking for a balance between cost-effectiveness and access to advanced trading features. It is characterized by low spreads, no commissions on trades, and flexible leverage to intermediate traders who want to deal with larger positions. The account is MT4/MT5 compatible and includes hundreds of instruments and technical analysis and automated trading features.

| Feature | Details |

| Minimum Deposit | No fixed minimum deposit (typically as low as $1) |

| Leverage | Up to 1 |

| Spreads | From 0.3 pips |

| Commission | No commission fees |

| Trading Instruments | Forex, Metals (limited compared to Standard Account) |

| Execution Type | Market Execution |

| Trading Platforms | MetaTrader 4 |

| Swap Fees | No swap fees on major forex pairs |

| Order Types | Market, Limit, Stop, Trailing Stop |

| Ideal for | Beginners, traders testing strategies with minimal risk, and those who prefer micro-lot trading |

Standard Cent Account

The Standard Cent Account was developed for beginning traders or

those who would like to try out their strategies on minimal capital. In this account, your trades are kept in cents, not dollars, so the risk exposure is lower while you hone your experience. It has some of the features identical to the Standard Account but with lower entry requirements, making it perfect for those who have just started trading or trade small volumes.

Key Features of the Standard Account

- No Minimum Deposit: Trade with whatever amount you want to; it is people-friendly.

- Low Spreads: The spreads start from as low as 0.3 pips.

- No Commission: No extra cost on the trade involves.

- Leverage: Variety in leverage options up to 1: Unlimited gives the customer more control over their trading strategy.

- Market Execution: Fast and reliable; your trade will be executed right at that moment, without holding.

Trading Platform: MT4 and MT5 for the ability to trade versatilely.

Standard Account—This account type, targeting new or professional traders, balances between affordability and rich functionality for trading.

How to Open an Exness Standard Account

Opening a Standard Account with Exness is not a difficult task at all and opens multiple financial instruments and an enormous amount of opportunities to trade. Whether the trader is a freshman or an expert professional, the users’ friendly platform at Exness will help all levels.

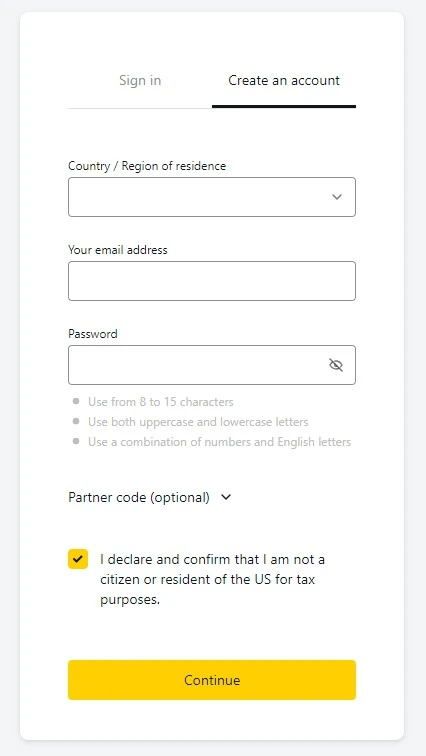

Registration Process

First of all, you need to register an account. It’s fast and will only take a few minutes.

- Go to My Exness: After visiting Exness’ website, click on “Open Account.”

- Enter your details: You will be asked to provide an e-mail, a password, and then the country you reside in.

- Verify your e-mail: Open your e-mail and confirm your e-mail address via the link received in the email.

- Fill in your profile: This is where you will fill in the relevant personal information that might be required, such as your name, address, phone number, and any other relevant information.

Upon registration, you can access the Exness trading platform with all its features.

Account Verification

Due to reasons of security and compliance with international regulations, Exness requires identification and address verification for all its new users. This is a standard international practice in the financial sector, known as Know Your Customer (KYC), which protects the interests of both the company and the client from fraud.

You will be required to upload an example of a government-issued ID, such as your passport or driver’s license, to verify your identity. A proof of residence address—this shall be in the form of any utility bill or bank statement received recently. Verification will usually take a few hours, and once your documents are cleared, the go-ahead will be given to enjoy the full trading facility with deposit and withdrawal options.

Funding Your Account

The next step after verifying your account is to fund it, so you can be able to trade. Exness has several varied payment methods so you can pick the one that best serves your needs.

- Bank Transfer: Safely transfer money directly from your bank account.

- Credit/Debit Card: Fund instantly with your Visa or MasterCard.

- E-Wallets: Instant deposits are allowed by Skrill, Neteller, and others.

- Cryptocurrencies: The possibility of funding with popular cryptocurrencies like Bitcoin.

Following funding, you would be able to start trading immediately in the financial markets.

Trading Conditions for Standard Account

Exness’ Standard Account is developed to provide users with competitive trading conditions, both for the beginning and experienced trader. Here’s what you can expect:

- Spreads: The low floating spreads start from 0.3 pips with major currency pairs. This reduces trading costs, which are a must for systems—both short- and long-term.

- Leverage: Exness has flexible leverage on accounts, which can go as high as 1: Unlimited. This feature enables one to retain and therefore operate larger positions with a smaller investment amount, which only increases the size of returns but increases risk.

- Execution: This standard account uses market execution that ensures filling your orders at the best available price and does not allow requotes. This is very important to traders who work within fast-moving markets.

- No Commissions: There are no extra charges of commissions over the trade, which makes it easy to work out your overall costs and probable profit.

- Minimum Order Size: This account will let one trade with a minimum order size of 0.01 lots, making it very accessible to people who want to start trading with smaller amounts.

- Trading Platforms: You’ll have the use of both MT4 and MT5 with a Standard Account, which provides all tools and features to enhance your trading experience.

- Stop-Out Level: The stop-out level is 0%, thereby giving you the leeway to hold onto positions in the market for so much longer, providing more room to recover before auto-close of positions.

Those are the trading conditions that make Exness’ Standard Account flexible and suitable for traders valuing flexibility, low cost, and efficiency in trading performance across all market conditions.

Comparison with Other Exness Accounts

Standard vs. Standard Cent

- Minimum Deposit:

- Standard Account: No minimum deposit; therefore, it becomes very much approachable to most traders.

- Standard Cent Account: No minimum deposit is required, either. It’s developed for people who are just beginners to trade and want to trade smaller volumes.

- Trading Volume :

- Standard Account: One can trade standard lots. 1 lot is 100,000 units. This sort of account will suit those who are ready to trade bigger volumes.

- Standard Cent Account: The trading is done in lots of cents, making it suitable for traders seeking to trade lower volumes with reduced risks.

- Spreads and Commissions:

- Standard Account: This account enjoys low spreads starting from as low as 0.3 pips on major FX pairs with no commissions applicable on trades, so most suited to a trader prioritizing minimization of trading costs.

- Standard Cent Account : The spread is also meager, slightly a notch above the Standard Account, but it doesn’t, however, levy any form of commission.

- Leverage

- Both Accounts: Leverage granted is up to 1: Unlimited. This avails the trader flexibility in management of the positioning.

- Target Group:

- Standard Account: Targeting beginners and experts ready to engage in plenty of trade in substantial funds.

- Standard Cent Account: Owing to its design, it targets extremely new traders or experts willing to experiment with scaling strategies through volumes of small amount accounts.

Standard vs. Professional Account

- Minimum Deposit:

- Standard Account: There is no such requirement for minimum deposit for this type of account, hence, making it very accessible.

- Professional Account: It requires a more significant minimum deposit compared to the other, usually starting at $200, hence targeting advanced traders.

- Spreads and Commissions:

- Standard Account: From 0.3 pips on the spread, with no commissions, making it the cheapest option for any new trader or active trader.

- Professional account: It offers even further reduced spreads from 0.0 pips; however, it adds a small commission per trade, so this offer would be more appropriate for high-volume traders that want the lowest possible spread.

- Order Execution:

- Standard Account: With market execution, filling orders at the fastest speed and the best prices is guaranteed.

- Professional Account: It also has market execution but with enhanced features, which can give faster execution speeds than the former category. In general, it is dedicated to providing traders with the finest possible conditions under which to trade, focusing on very demanding clients.

- Leverage:

- Leverage Options: Both Accounts: The leverage options go up to 1:Unlimited with the Standard Account and a range with the Professional Account—still flexible, but it may be a bit more conservative depending on which exact Professional Account is opened.

- Trading Platforms:

- Both Accounts: Accessible on both MT4 and MT5, though it’s possible some advanced tools and resources might get added to the Professional Account.

- Intent :

- Standard Account: Suited for most traders, both beginners and those with moderate experience.

- Professional Account: Ideal for experienced traders who want tighter spreads and advanced features but are comfortable paying commissions for the potential of better execution.

These comparisons will assist you in picking the account type with Exness that best suits your trading style, risk tolerance, and investment goals.