Exness Account Types

Exness offers an extensive range of account types so as to facilitate all trading demands and experiences. The Standard and Standard Cent Accounts are designed for those just starting off and those who want to trade small volumes at the most minimum cost. The Pro, Raw Spread, and Zero Accounts supply advanced traders with that reduced spread, professional-grade trading conditions, and the whole set of advanced peculiarities. Each type of account is designed to provide a tailored trading experience, with every possible condition in the market.

Exness Account Types Overview

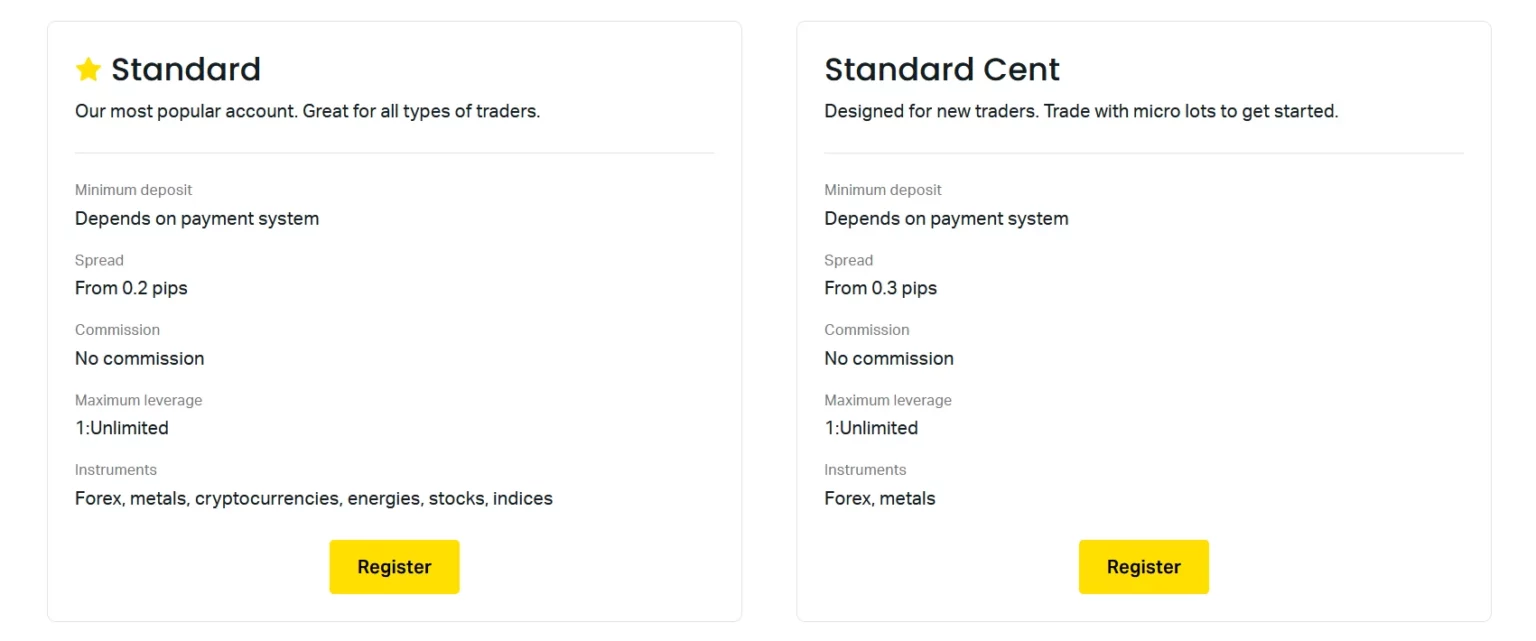

Exness has varieties of account types that help different levels of traders and styles. The Standard Account and Standard Cent Account would help the beginner and those who want to place small trades. The spread is low, and no commission is charged on the Standard Account; it is economically friendly to new traders. The Standard Cent Account is also quite perfect for anyone who wants to practice trading with minimal risk since you can trade in lots of cents, which means a small volume compared to standard lots.

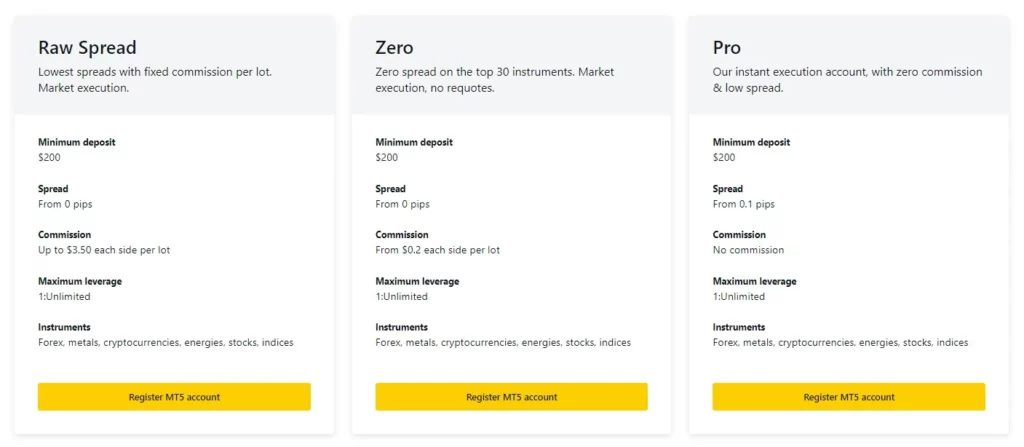

For Exness, there exist professional accounts such as the Pro Account, Raw Spread Account, and Zero Account. The Pro Account aims at professional traders who want ultra-tight spreads, no commissions, and fast market execution. The Raw Spread Account allows for spreads as low as 0.0 pips, in addition to one of the most competitive commissions per lot in the industry, against near-direct market conditions. Finally, the Zero Account pairs ultra-low commissions with zero spreads on major pairs, hence placing this account at a very competitive level among traders for whom the demand for precision and transparency regarding trading costs is at its peak. Each of these accounts is intended to provide its special features, targeted at different trading styles and preferences.

Exness Standard Accounts

Exness Standard Accounts are flexible and user-friendly trading options, be it for a newcomer or a professional trader. A great variety of financial instruments is available for trading, among them Forex, metals, and cryptocurrencies. The reason the Standard Account is so popular is that it provides competitive trading conditions along with the needed simplicity for traders to pursue strategies without hassles from hidden fees or complicated terms.

Some key features of Exness Standard Accounts include the following:

- There is no minimum deposit required to trade; hence, it is available to all traders. Spreads are low, from as low as 0.3 pips.

- No commissions on trades. This makes it easier to control costs.

- Market execution model grants for fast and secure trade execution.

- MT4 and MT5 trading platforms are available.

Exness Professional Accounts

Exness Professional Accounts are developed for older traders who have higher requirements regarding trading conditions. These accounts have tighter spreads and execution speed, with additional features targeting high-volume and high-frequency traders. Professional Accounts include the Pro Account, Raw Spread Account, and Zero Account, which all provide certain benefits that will satisfy various styles and strategies of trading.

Key features of Exness Professional Accounts:

- No pip spreads with 0.1 pips on the Pro Account and 0.0 pips on Raw Spread and Zero Accounts.

- Very low commissions on Raw Spread and Zero Accounts for cost effectiveness.

- Super-fast and accurate market execution for every trade.

- Multi-asset platform: Forex, metals, and many other instruments at your service.

- Advanced trading tools and features available on MT4 and MT5 platforms.

Exness Islamic Account

The Exness Islamic Account refers to a special interest-free trading environment created for traders adhering to Sharia law. The swap or rollover fee for overnight positions will be eliminated in this type of account, thus being fully compliant with the principles underpinning Islamic finance. Therefore, traders using the Islamic Account will get an opportunity to enjoy very competitive trading conditions brought forth by Exness without their religious beliefs being compromised.

Some key features of the Exness Islamic Account are as follows:

- No swap or rollover fees are charged on overnight positions;

- Very competitive trading with the same spreads and conditions as other account types;

- All major account types available, including Standard and Professional Accounts;

- Huge array of trading instruments to trade: Forex, metals and cryptocurrencies;

- Accessible on MT4 and MT5 both.

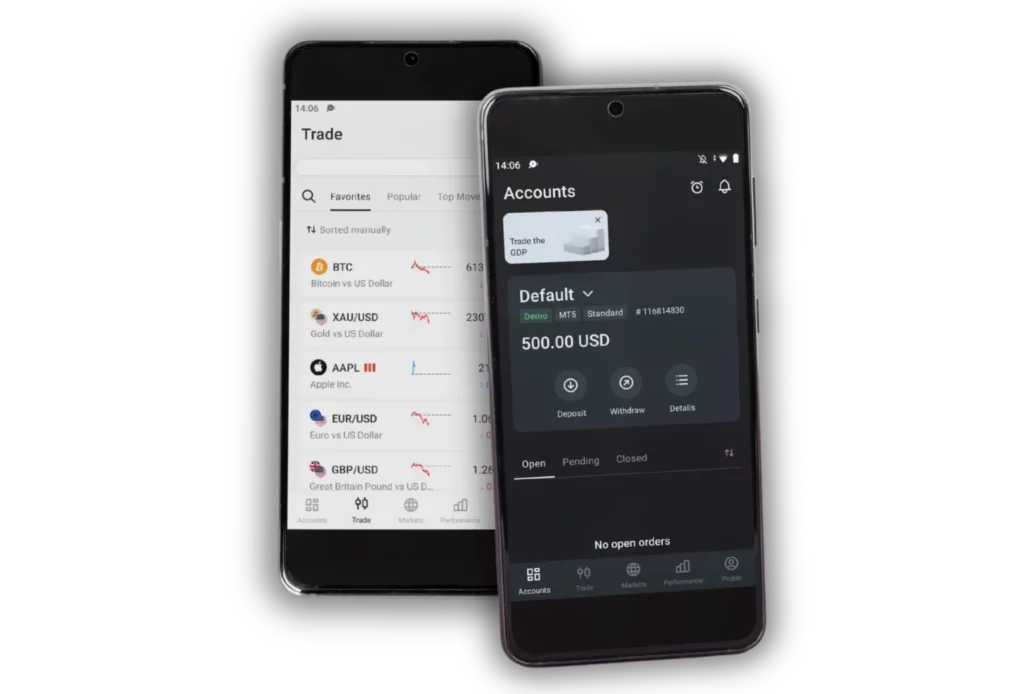

Exness Demo Account

An Exness Demo Account is useful for both new and experienced traders to practice and fine-tune their trading strategies without risking real money. It has a simulated trade environment that replicates the live market so that users can practice a couple of trades, grasp some of the platform features, and become conversant with the trading process.

The Demo Account allows traders to experiment with a wide selection of instruments, including Forex, Metals, and Cryptocurrencies, using virtual funds. This way of trying out the platform is tremendous because the investor can also test trading strategies and get a feel for how market conditions could impact trades without risking any real money. An Exness Demo Account is particularly useful in instilling confidence needed to trade with real funds among newcomers but is also useful in trying out new strategies with experienced traders.

Exness Social Account

The Exness Social Account is a unique offering that offers traders the opportunity for social trading, where one can simply follow and copy the strategy of experienced traders. It will appeal to people who would like to participate in markets but cannot spend enough time or acquire enough knowledge and experience to become successful independent traders. With Exness Social Account, you are able to scroll through the list of successful traders, analyze their performance, and choose to replicate trades in your own account. It mirrors your strategies automatically in real-time.

This account will suit both starters who want to learn from experienced traders and those who want to trade on a more passive note. With Exness Social Trading, you are guaranteed a diversified portfolio with the experience of others, yet you do not have to actively manage your trades. It’s an accessible way to participate in financial markets while leveraging the insights and success of top traders.

The main features in the Exness Social Account are as follows:

- You can copy trades made by professional traders within the Exness Social Account.

- You get access to performance stats of top traders, hence you will find it quite easy to make informed choices.

- There are no extra commissions involved in copying trades, which makes the transaction costs real and transparent.

- Options on investment levels are available in order to accommodate different levels of risk and trading strategy.

- Trades are synchronized in real-time to keep your account aligned with the strategies being followed.

Choosing the Best Exness Account for Beginners

When one has to choose the best Exness account for beginners, it would be the Standard and Standard Cent Accounts. The former is perfect for those who are just starting their way into trading, with very low spreads starting from 0.3 pips and no commission, thus very cheap and easy. The latter, the Standard Cent Account, is most appropriate in case you want to trade smaller volumes, thus putting yourself at a lower risk by allowing trade in cent lots. The two accounts offer a great variety of trading instruments on easy-to-use MT4 and MT5 platforms, which really will be suitable for people who only want to start their path in trading.

Minimum Deposits for Exness Accounts

It has several types of accounts with a flexible minimum deposit requirement, making it more available to traders at different levels of experience and investment capacity. More specifically, the Standard Account and the Standard Cent Account seem rather friendly to beginners, as they do not require a specific minimum deposit. It only means that traders could start with any amount they want and feel comfortable with, making them perfect for those who are just entering the sphere of trading or prefer to start with a smaller investment.

Exness has a Pro Account, a Raw Spread Account, and a Zero Account designed for more advanced and professional traders. The minimum deposit into these accounts usually is $200. This increased deposit takes into consideration the improved conditions and tighter spreads these accounts have. All these accounts have been tailor-made to suit professional traders’ needs and those seeking more from their trading environment.

Minimum deposit information:

- Standard Account: No minimum deposit is required.

- Standard Cent Account: No minimum deposit is required.

- Pro Account: The minimum deposit is $200.

- Raw Spread Account: The minimum deposit is $200.

- Zero Account: The minimum deposit is $200.

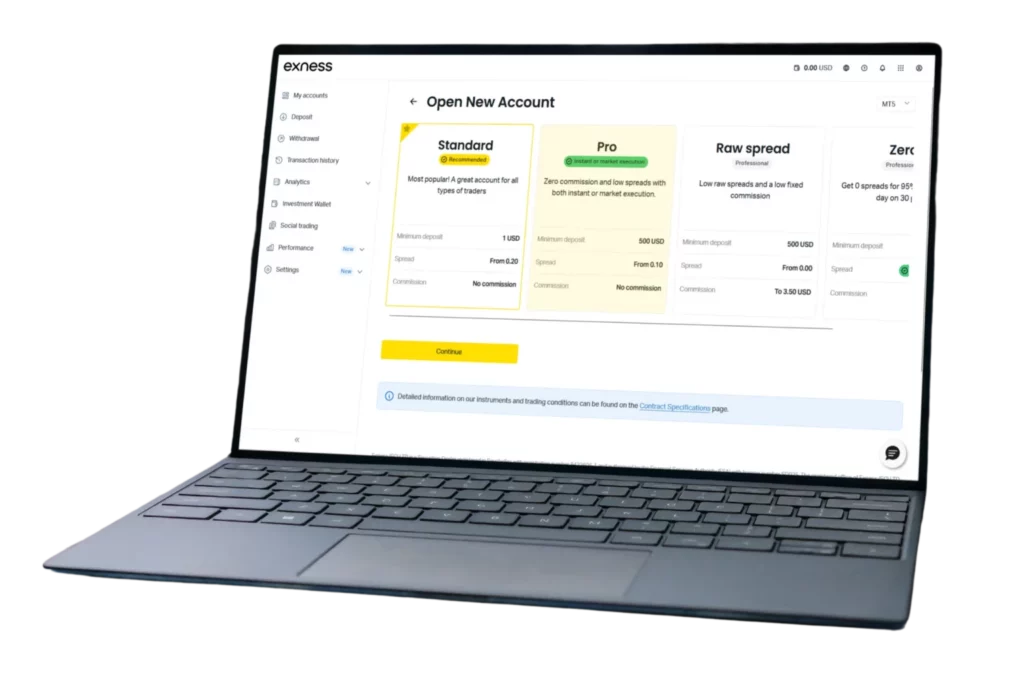

Steps to Open an Exness Account

Opening an Exness account is quite easy and only requires a few steps. The steps to get started are described below:

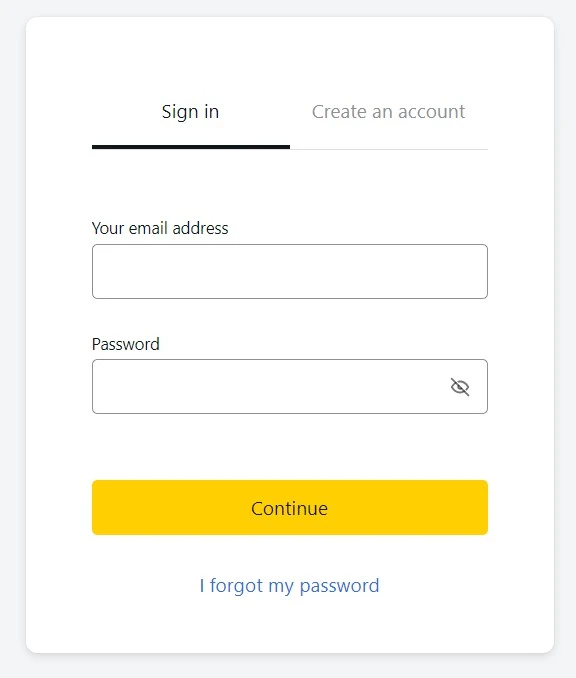

- Exness Website: Log in to the official website of Exness. Here, at the top-right corner, you will find the button “Open Account”.

- Register Your Details: Enter your email address, create a password, and indicate your country of residence. You have to specify what type of account you want to open.

- Verify Your Email: Check your inbox for the verification email sent by Exness. Click on the link provided to confirm your email address and proceed for registration.

- Complete Your Profile: Add more personal information; enter your full name, phone number, and address. Fill this information in; it is necessary for your account to be fully activated.

- Verify Your Identity: Attach all documents proving your identity and residence. This typically means a government-issued ID, like a passport or driver’s license, and a utility bill or bank statement that is no older than six months.

- Fund Your Account: After verification, you can start funding your account with an initial deposit. You will have various methods of deposit at your disposal, which include bank transfer, credit/debit cards, e-wallets, or even some major cryptocurrencies.

- Start Trading: You can instantly start trading when your account is funded using any of the Exness trading platforms, be that MT4 or MT5.

With this, you are all set and ready to trade on the Exness platform—into a world of a wide variety of instruments for trading and advanced tools to complement them.

Verifying Your Exness Account

Account verification is an important step to the full activation of your trading account on Exness, whereby various features are availed. It is meant to ensure that your account is within the limits set by regulatory standards, hence it serves to elevate security measures in your transactions. This is how one can verify their Exness account:

- Identity Verification: Submit a clear, valid government-issued photo ID, such as a passport, national ID card, or driver’s license. The document should clearly display your full name, date of birth, and contain a photo.

- Address Verification: Attach any of the following documents, which should be recent and not more than six months old, furnishing residential address verification. A utility bill, a bank statement, or any such document with the student’s name and current address would suffice.

- Wait for Verification Approval: Your documents will then be forwarded to the verification team of Exness for review. This procedure generally takes only some hours but could take up to 24 hours in exceptional cases. You will then receive a confirmation email after this step has been completed.

- View Full Account Features: Successfully verifying your account will give you a view of full account features. This includes higher deposit and withdrawal limits, enabling you to start trading with real money immediately.

Verification of the Exness account is a significant measure toward a safe trading environment, but it is also required under international financial regulations. It will also ensure that no person can enter your account unauthorized to view or use your funds and information.

Pros & Cons of Exness Accounts

Standard Account

Pros:

- Low Minimum Deposit: Open to beginners with low starting capital.

- No Commission Fees: No commission fees reduce trading costs.

- High Leverage: Leverage from 1 to 1.

- Broad Instrument Range: FX, metals, cryptos, and a lot more.

- Fast Trade Execution: Fast trade execution in the most volatile markets.

- No Swap Fees on Majors: Ideal for long term strategies.

Cons:

- Higher Spreads: Trading with higher costs compared to other account types.

- Market Execution: Little price variations likely in very volatile markets.

- Overleverage Risk: High leverage may lead to heavy losses.

- Basic Features: It lacks all the enhanced tools and features that advanced traders would desire.

Standard Cent Account

Pros:

- Low Minimum Deposit: Accessible for as low as $1.

- Micro Lot Trading: Perfect for beginners or testing strategies with minimal risk.

- No Commission Fees: No extra commission fees are charged on trades.

- High Leverage: Leverage provided up to 1

Cons:

- Wider Spreads: Spreads offered are wider compared to other types of accounts.

- Fewer trading instruments are available compared with other accounts, and instruments are limited.

- Basic Features: Advanced trading tools for professional traders are not available.

Pro Account

Pros:

- Tight Spreads: This platform gives market players very competitive spreads from as low as 0.1 pips, which bring down the trading costs.

- No Commission Fees: The commission-free trading will, hence, help leverage the high-frequency traders.

- Fast Execution: This allows for ultra-fast execution in the market, quite important for scalping and day trading.

- Variable Leverage: Several leverage options of up to 1

- It allows for tailored risk management.

- Access to all instruments: a diversified suite of trading instruments, from forex and metals to cryptos and much more.

Cons:

- Higher Minimum Deposit: Has a minimum deposit requirement higher than Standard accounts.

- Market execution: Like the other accounts, market execution can cause slight variance of prices in times of high instability.

- Not Good for Beginners: Great for experienced traders due to the higher requirements for capital and a more sophisticated trading environment.

Raw Spread Account

Pros:

- Tightest Spreads: Offering raw spreads from as low as 0.0 pips means very cost-effective trading.

- High Transparency: Spreads reflect real market conditions; there are no markups.

- Fast Execution: Quick execution speeds, scalable for scalping and high-frequency trading.

- All Instruments at Hand: This is a fully equipped platform with access to an overwhelming number of assets from forex, metals, and more.

- Professional Trading Environment: This caters to the needs of more advanced traders who would like effective control over trading costs.

Cons:

- Commission Fees: The commission per trade could be an expensive deal while the spreads are low and might add up for frequent traders.

- Higher Minimum Deposit: Its minimum initial deposit is higher compared to the Standard accounts.

- Complexity: Less appropriate for beginners, since more advanced trading strategies would be required, and it has higher costs if not managed appropriately.

Zero Account

Pros:

- Zero Spreads: offers as low as zero spreads on major currency pairs, thus defining accurate entry and exit points.

- Fast Execution: Execution in the market is ultra-fast, very conducive to scalping and high-frequency trading.

- Flexible Leverage: Leverage up to 1

- This enables traders to maximize their potential returns.

- Access to a Great Variety of Instruments: Trade Forex, Metals, Indices, and Other Various Assets.

- Professional Trading Conditions: The trading conditions are made for traders who have to tightly control their costs and who appreciate transparency.

Cons:

- Commission Fees: These are added to trades and thus increase the total cost of trading.

- Higher Minimum Deposit: It has a requirement for an initial deposit that is large and not generally within the reach of most people entering the business.

- Market Execution: There may be small price movements under very volatile markets, thereby affecting the execution of a trade upon the price asked for.

Islamic Account

Pros:

- No Swap Fees: Absolutely no swap fees involved, according to rules of Islamic finance.

- Available on All Three Account Types An applicable option for Standard, Pro, Raw Spread, and Zero accounts presents traders with the highest level of flexibility in their trading preferences.

- Broad range of instruments: Trade all instruments without having to pay overnight fees.

- No Extra Charges: Exness applies no extra commissions in its effort to compensate for the swap fees, making it honey for fairness.

Cons:

- Availability Limited: Available only to traders from some regions, hence curtailing its access to some users.

- Slightly Wider Spreads Possible: This may result in the spreads for some accounts being slightly wider than those realized under non-Islamic accounts, to compensate for eliminating the swap fees.

- Not Appropriate for Short-Term Traders: This feature of swap-free trading generally does not benefit traders who do not hold positions overnight.

Demo Account

Pros:

- Risk-Free Trading Environment: The Demo account lets a user practice trading with money that is virtual, thus with no financial losses while learning the platform and testing strategies.

- Access to all features: With Exness Demo, most of the trading instruments are accessible, while all of the features of a live account are gained; this means a trader will be fully exposed to an actual trading experience.

- Unlimited Use: Often, one can use Demo accounts for an unlimited time to build confidence and work on the refinement of trading skills.

- Real-Time Market Conditions: The account simulates actual market conditions, providing a close-to-reality trading environment that helps a user prepare for real trading.

Cons:

- No Emotional Involvement: Because it is not real money to play with, there may not be the emotional attachment to trading that would occur when opening a live account, which may create a disadvantage later in switching over to trading for real.

- Unrealistic Expectations: Because there is no actual financial risk, one may be more aggressive in trading behavior, which will possibly create unrealistic expectations when moving on to a live account.

- Differences in execution: Even though the practice accounts make claims to imitate live conditions, there is a disparity in the speed of order execution and possible slippage, which might not replicate the trading experience very realistically.

Social Account

Pros:

- Copy Trading Convenience: The Social account provides easier access for copy trading. This particularly helps those who are just entering the market and, as a result, looking to follow and replicate others who’ve been in the trade for some time.

- Diversified Strategies: Having numerous trading strategies, various traders offer diversification of investment strategies.

- Low Entry Requirements: Most social trading accounts require a low minimum deposit, therefore making them accessible to many investors.

- Transparency: Detailed performance metrics of strategy providers are given within the platform, thus allowing its users to make fully informed decisions regarding who to follow.

Cons:

- Dependent on Providers of Strategies: As the dependence on providers’ performance is high, the Social Account may result in an inconsistent manner.

- Possible Fees: It involves copy-trading or performance-based fees, which may impact the profitability of the process.

- Limited control: The trade has very limited control as one is at the mercy of the strategy providers followed.

Conclusion

Exness provides a great variety of account types that can satisfy many different kinds of traders, from newbies to professionals. For example, the Standard and Standard Cent accounts provide the least demanding entry conditions and simple, straightforward conditions. At the same time, more professional traders have at their disposal Pro, Raw Spread, and Zero accounts with such advanced features as ultra-tight spreads and low commissions—this way, they can work out more accurate and cost-effective trading strategies. The Islamic Account is specifically designed to be in compliance with Sharia law by facilitating trades without interest. Overall, Exness allows traders the flexibility to choose types of accounts that best suit their trading style, tolerance toward risk, and the predefined goals regarding finances.